likelihood of capital gains tax increase in 2021

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

Published on 22nd Jan 2021.

. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. So if you buy 10000 in stock and sell those shares five years later for 20000 you will likely. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

It would also nearly double taxes on capital gains to 396 for people earning more than 1 million. Implications for business owners. The Covid-19 crisis has exacerbated the need to raise additional tax revenues and an increase in CGT rates wont break the governments.

Note that short-term capital gains taxes are even higher. The lifetime capital gains exemption is. The Chancellor will announce the next Budget on 3 March 2021.

2022 capital gains tax rates. That would be the highest tax rate on investment gains which are mostly. Capital gains taxes simply are taxes levied on profits from selling an investment.

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. The current capital gain tax rate for wealthy investors is 20. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit.

Many speculate that he will increase the rates of capital. Capital Gains Tax 101 Selling Stock How Capital Gains Are Taxed The Motley Fool. While it is unknown what the final legislation may contain the elimination of a rate.

2021 capital gains tax calculator. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

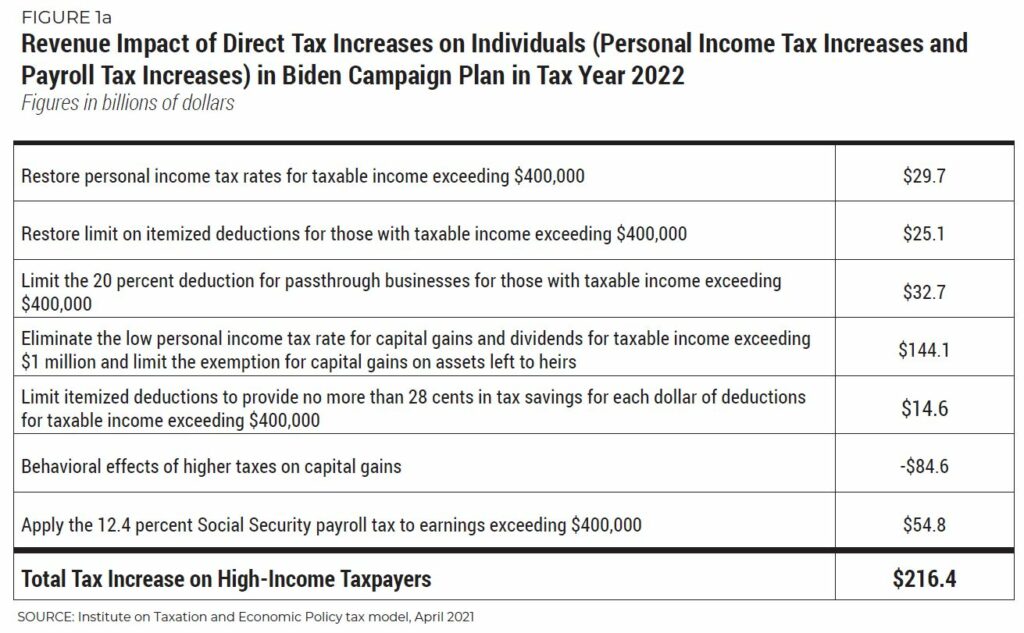

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Capital Gains Taxes And Asset Types

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Can Capital Gains Push Me Into A Higher Tax Bracket

September 13 2021 Update Democrats Propose New Tax Increases Srs

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

What Are The Capital Gains Tax Rates For 2020 And 2021

Business Capital Gains And Dividends Taxes Tax Foundation

Effects Of Changing Tax Policy On Commercial Real Estate

Daniel Clifton On Twitter Despite Wrangling Over A Bipartisan Infrastructure Deal The Betting Odds Of A Corporate Tax Rate Increase Moved Higher Over The Weekend Likely Based Off Manchin S Comments Support

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

New Tax Initiatives Could Be Unveiled Commerce Trust Company

What You Need To Know About Capital Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra